Great Tax Benefits to You

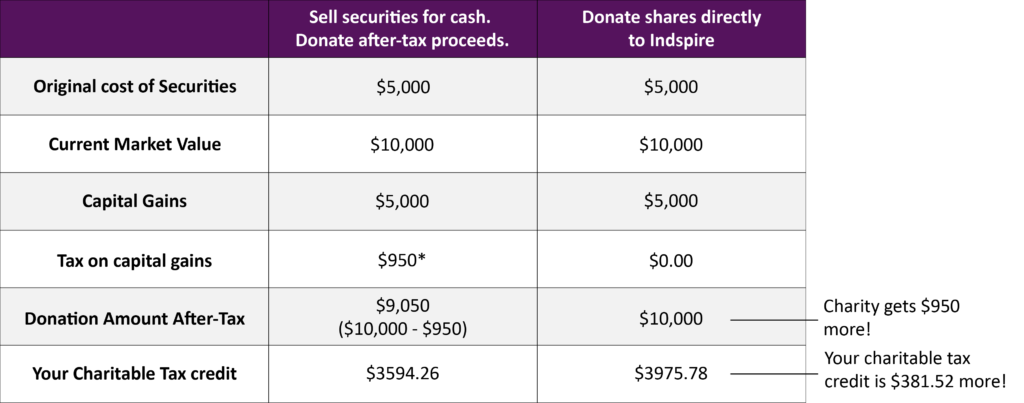

If you own stocks or mutual funds that have grown in value, you may face a tax bill when you sell them. By donating them directly to Indspire you reduce your tax bill and make a significant gift at the same time. You can give a gift of publicly traded securities to Indspire and eliminate 100% of the capital gains tax.

Benefits to You

- Make a Difference – Through your gift you will receive the opportunity to make a significant difference.

- Tax Advantages – By donating your appreciated securities or mutual funds directly to Indspire you eliminate your capital gains taxes.

- Reduced Brokerage Fees – Many brokerage houses forego fees for charitable transactions.

- Simple and Convenient – Securities are easy to transfer. Just fill out the form below and provide it to your broker. Your broker will transfer the shares from your account to Indspire’s brokerage account. The date of your donation will be the date the securities are deposited into our brokerage account.

- Recognition – Your gift can be honoured during your lifetime.

How does it work?

A donation receipt is issued for the fair market value of the securities on the date of the transfer of the ownership to Indspire.

To make a gift of stocks or securities to Indspire, download the following guidelines with transfer form:

*assumes a marginal tax rate of 38%

scenario for illustrative purposes only

Please Seek Expert Advice

Indspire strongly recommends that you seek professional advice to ensure your financial goals are considered, your tax situation reviewed, and that your planned gift is tailored to your own circumstances. Indspire recommends that you consult your lawyer or estate planner regarding the specific wording of any gifts of stocks and securities or other type of planned gift.

For more info, please contact:

Kate Espina

Director, Major Gifts

kespina@indspire.ca

1-855-INDSPIRE (463-7747) x0262